2011 has already had more history-shattering events than almost any other year since World War 2. Revolutions have swept the Middle East and much of Africa, a new war has erupted in Libya, Japan has experienced an unprecedented tsunami and a horrific nuclear crisis, the price of oil is skyrocketing, multiple nations in Europe are experiencing a financial meltdown and budget issues have pushed the U.S. government to the verge of a shutdown. In past years, it always seemed like there was time to "catch our breath" between each major crisis, but now huge events are striking in rapid-fire succession. We live at a time when wars, rumors of wars, natural disasters, bizarre occurrences and major financial problems are becoming so common that they hardly shock us anymore. 2011 truly has been one wild and crazy year, and the world is literally being transformed right in front of our eyes.

For a moment, let's review some of the history-shattering events that we have witnessed this year so far and the impact that they have had on the financial world....

#1 The Japanese Tsunami

When the tsunami struck Japan back on March 11th, most of us did not even understand what we were seeing. After all, who had ever heard of a massive wall of water sweeping 6 miles inland?

Thousands upon thousands of Japanese were killed and entire cities were wiped off the map. The Japanese economy has been absolutely devastated. Global supply chains are in a state of chaos.

Prior to this disaster, Japan was the third largest economy in the world. But now it is going to take them decades to fully recover. Some towns and cities may never be rebuilt. Japan will not be in a position to buy up more U.S. government debt for a long, long time. The economic balance of power in Asia is going to shift even more in the direction of China.

#2 The Japanese Nuclear Crisis

We will probably not know the full extent of the nuclear crisis in Japan for quite some time. Every day the news just seems to get worse. According to the Los Angeles Times, seawater near the Fukushima nuclear complex was recently found to contain "iodine-131 at 7.5 million times the legal limit".

If that wasn't bad enough, now Japanese authorities have announced that 11,500 tons of "moderately radioactive" water are going to be purposely released into the Pacific Ocean.

Japan's neighbors are becoming increasingly alarmed. Some South Korean schools closed on Thursday due to fears about radioactive rain and India has banned all imports of food from Japan.

The future of the nuclear power industry in Japan is in serious doubt. There are some people that believe that the Japanese seafood industry is going to be absolutely destroyed by all of this.

Even more importantly, there is going to be at least some portion of northern Japan that is going to be uninhabitable even after this crisis has been resolved. In addition, the health impact of this crisis is going to be felt for decades and will probably never be fully known.

#3 Revolutions In The Middle East And Africa

For some reason, revolutions have erupted all over the Middle East and Africa this year. First we saw revolutions take place in Algeria and Tunisia and then we witnessed the unprecedented events in Egypt. Now there are protest movements in almost every major Arab country.

All of this chaos in the Middle East is pushing the price of oil up to frightening levels. At last check, U.S. oil was above $110 a barrel and Brent crude was far higher than that. The last time oil prices were this high was in 2008 and by the end of that year world financial markets had absolutely crashed.

Will the same thing happen again this year?

Also, could it be that we have reached the end of the "cheap oil" era? If so, what will that mean for the future of the global economy?

#4 War In Libya

For some reason, the U.S. and the EU have decided that it is a good idea to go to war in Libya. But they aren't putting any boots on the ground yet. Right now they are just sticking to air strikes.

But it doesn't look like air strikes alone are going to be enough to force Gadhafi out.

So are the U.S. and the EU going to invade Libya at some point? If not, would they actually allow Gadhafi to remain in control of Libya after everything that has happened?

But Libya is not the only place where international forces have gotten involved. UN forces have also been conducting air strikes in the Ivory Coast.

So is this how it is going to be from now on? The "international community" is going to start bombing whenever the internal political situation in a nation is not "acceptable"?

The global elite may believe that "policing the world" is a good idea, but the truth is that it sets a very dangerous precedent and it makes the globe a much less stable place.

#5 U.S. Government Shutdown?

If the Republicans and the Democrats do not come to a budget agreement before midnight tomorrow, there will be a government shutdown. This will not be the end of the world and it has happened a number of times before. If it does happen, hopefully it will be for just a few days.

But this shows just how bitter politics have become in American right now. The truth is that the amounts they are arguing over aren't even that large. The Republicans are proposing $61 billion in budget cuts which would cut the budget deficit for 2011 by only 3.8 percent. The Democrats are proposing $33 billion in budget cuts which would cut the budget deficit for 2011 by just 2.1 percent.

So what is going to happen when it comes time to raise the debt ceiling?

And what is the battle over next year's budget going to look like?

Sadly, the truth is that neither party seems to be serious about balancing the budget any time soon.

As I have written about previously, the U.S. government has a very serious debt management problem. Something needs to be done about this debt crisis immediately. We simply cannot stay on the road that we are on.

It is being projected that U.S. government debt will rise to about 400 percent of GDP by the year 2050. Of course that will never happen because we will have a complete and total financial collapse in this country long before then if nothing changes.

#6 The European Debt Crisis

Guess what?

Portugal has decided that they are going to need a bailout after all.

Greece and Ireland have already received bailouts. There are persistent rumors that both of them will need more bailouts at some point.

Spain, Italy, France and Belgium are also drowning in an ocean of unsustainable debt. The European debt crisis just seems to get worse with each passing month. The bonds of several European nations have been significantly downgraded in recent weeks. More rating downgrades are being threatened.

It is getting very expensive for some of these governments to continue to borrow money. For example, the yield on 10-year Greek bonds recently reached an astounding 12.82%. This is putting an incredible amount of pressure on the European financial system.

For now the bailouts are continuing, but the Germans cannot bail everyone in Europe out forever. At some point this entire mess may come crashing down.

#7 The Protests In Wisconsin

As the recent protests in Wisconsin demonstrated, the American people are not going to take austerity measures sitting down. New life has been breathed into the organized labor movement in America. As a result, in many areas of the country it is going to be really hard for state and local governments to make the deep budget cuts that many believe are necessary.

What the protests in Wisconsin also showed is that America is a deeply, deeply divided nation. Liberals hate the Tea Party and the Tea Party hates liberals. The growth of frustration and anger in American politics is alarming.

Meanwhile, both sides are not even focusing on the real sources of our economic problems. Most Americans don't really understand what a "trade deficit" is and most Americans certainly cannot adequately describe what the Federal Reserve is.

The ignorance of the American people is staggering. In fact, 63 percent of Americans between the ages of 18 and 24 cannot find Iraq on a map and 90 percent of Americans in that same age group cannot find Afghanistan on a map.

But what Americans do know is that they are mad and that they want to take it out on someone. Sadly, we will probably continue to take it out on each other as the real problems go unaddressed.

#8 Quantitative Easing

QE2 technically started late last year, but the effects really only started to kick in this year.

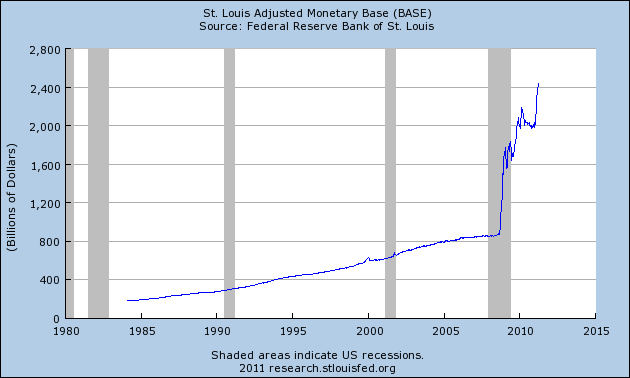

Essentially what the Federal Reserve is doing is that they are creating money out of thin air and using it to buy up huge amounts of U.S. Treasuries.

In the process, the big Wall Street banks are making substantial profits (because they are who the Fed buys the Treasuries from) and the U.S. money supply is exploding.

Just check out what all of this quantitative easing is doing to the U.S. monetary base....

#9 The Global Food Crisis

All of the crazy money printing that the major central banks around the globe have been doing is starting to have some very serious consequences.

One thing that is happening is that the global price of food is soaring. Earlier this year the UN announced that the global price of food hit a brand new all-time record high.

For people in rich countries higher food prices are an inconvenience, but in third world nations a 20% increase in the price of food can mean the difference between life and death.

The truth is that the globe is headed for a massive food crisis. The price of almost every major agricultural commodity has skyrocketed over the past year.

For example, the price of corn has more than doubled over the last 12 months. Not only that, according to the U.S. Department of Agriculture U.S. corn reserves will drop to a 15 year low by the end of 2011.

If things get much worse we will likely see many more food riots begin to erupt around the world.

#10 George Soros Attempts To "Rearrange" The World Financial System

It hasn't gotten much attention in the mainstream media, but George Soros is actually attempting to restructure the global financial system.

Soros is holding an international financial conference from April 8th to April 11th in Bretton Woods, New Hampshire.

Many are referring to this conference as "Bretton Woods II". The following is how a recent article on AmericanFreePress.net described this conference....

This “Bretton Woods II” comes along just as the Trilateral Commission will be meeting at the same time in Washington, D.C. With an apparent goal of creating nothing less than a new global economy, Soros is spending $50 million in New Hampshire to bring together up to 200 academic, business and government policy leaders under his Institute for New Economic Thinking (INET).

As AFP goes to press, the attendees are to include ex-Fed Chairman Paul Volcker, former British Prime Minister Gordon Brown and World Bank executive and Nobel Prize winner in economics Joseph Stiglitz. The conference is slated for the Mount Washington Hotel, site of the historic 1944 Bretton Woods conference, which established the post-World War II international financial architecture.

So is this conference going to change the financial world as we know it?

Only time will tell.

But the truth is that George Soros is not afraid to swing for the fences and he is very obsessed with his globalist agenda.

In any event, it is undeniable that 2011 has been a really wild and crazy year so far.

So what will the rest of the year bring?

Hopefully the chaos will settle down a bit, but I wouldn't count on it. The entire global financial system is starting to come apart and so the economic nightmares are probably just beginning.

If your dream was to live in stable, peaceful times than you are probably not going to enjoy the years ahead very much.

But if you always wanted to live during a time when history was being made and when there are great adventures to be experienced then the years ahead are going to present a great opportunity for you.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.