The U.S. middle class is being shredded, ripped apart and systematically wiped out. If you doubt this, just check out the statistics below. The American Dream is being transformed into an absolute nightmare. Once upon a time, the rest of the world knew that most Americans were able to live a middle class lifestyle. Most American families had nice homes, most American families had a car or two, most American families had nice clothes, most American families had an overabundance of food and most American families could even look forward to sending their children to college if that is what the kids wanted to do. There was an implicit promise that this was the way that it was always going to be. Most of us grew up believing that if we worked really hard in school and that if we stayed out of trouble and that if we did everything that "the system" told us to do that there would be a place for us in the middle class too. Well, it turns out that "the system" is breaking down. There aren't enough good jobs for all of us anymore. In fact, there aren't very many crappy jobs either. Millions are out of work, millions have lost their homes and nearly all of the long-term economic trends just keep getting worse and worse. So is there any hope for the U.S. middle class?

No, there is not.

Unless fundamental changes are made economically, financially and politically, the long-term trends that are destroying the U.S. middle class will continue to do so.

The number of good jobs has been declining for a long time. The good jobs that have been lost are being replaced by a smaller number of low paying "service jobs".

Meanwhile, the cost of everything is going up. It is getting really hard for American families to be able to afford to put food on the table and to put gas in the tank. Health care costs are absolutely outrageous and college tuition is now out of reach for millions of American families.

Every single month more American families fall out of the middle class. Today there are 18 million more Americans on food stamps than there were just four years ago. More than one out of every five U.S. children is living in poverty. Things are getting really, really bad out there.

The following are 36 statistics which prove that the American Dream is turning into an absolute nightmare for the middle class....

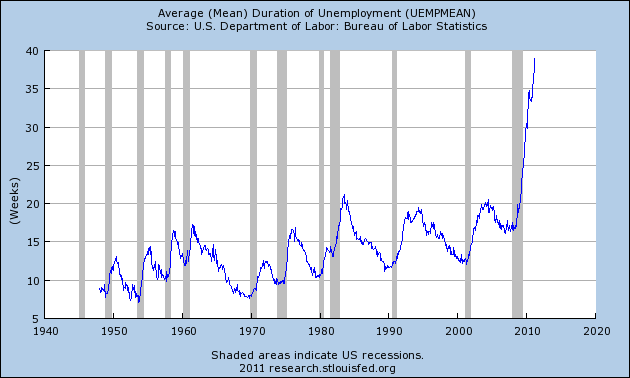

#1 The competition for decent jobs in America has gotten absolutely insane. There have been reports of people actually getting down on their knees and begging for jobs. Many Americans are starting to wonder if they will ever get a decent job again. According to the U.S. Bureau of Labor Statistics, the average duration of unemployment in the United States is now an all-time record 39 weeks....

#2 According to the Wall Street Journal, there are 5.5 million Americans that are unemployed and yet are not receiving unemployment benefits.

#3 The number of "low income jobs" in the U.S. has risen steadily over the past 30 years and they now account for 41 percent of all jobs in the United States.

#4 Only 66.8% of American men had a job last year. That was the lowest level that has ever been recorded in all of U.S. history.

#5 Once upon a time, anyone could get hired at McDonald's. But today McDonald's turns away a higher percentage of applicants than Harvard does. Approximately 7 percent of all those that apply to get into Harvard are accepted. At a recent "National Hiring Day" held by McDonald's only about 6.2 percent of the one million Americans that applied for a job were hired.

#6 There are now about 7.25 million fewer jobs in America than when the recession began back in 2007.

#7 The United States has lost an average of about 50,000 manufacturing jobs per month since China joined the World Trade Organization in 2001.

#8 A New York post analysis has found that the rate of inflation in New York City has been about 14 percent over the past year.

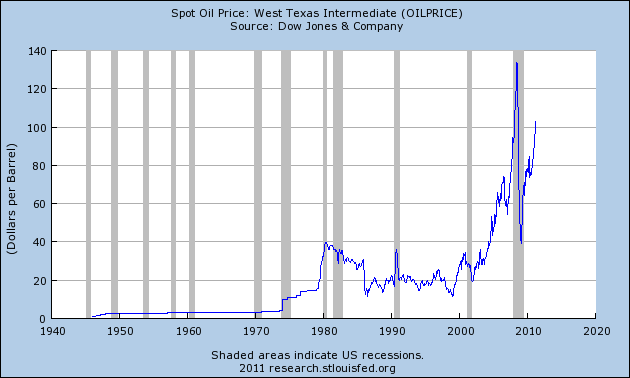

#9 The average price of a gallon of gasoline in the United States is now up to $3.91 a gallon.

#10 Over the past 12 months the average price of gasoline in the United States has gone up by about 30%.

#11 Spending on energy now accounts for more than 6 percent of all consumer spending. Every time this has happened since 1970 we have also had a recession that followed.

#12 The average American driver will spend somewhere around $750 more for gasoline in 2011. Unfortunately, it seems likely that the price of oil is going to go up even higher. Already the price of oil is closing in on the all-time record....

#13 In the United States, over 20 percent of all children are living in poverty. In the UK and in France that figure is well under 10 percent.

#14 According to the U.S. Census, the number of children living in poverty has gone up by about 2 million in just the past 2 years.

#15 The wealthiest 1% of all Americans now own more than a third of all the wealth in the United States.

#16 The poorest 50% collectively own just 2.5% of all the wealth in the United States.

#17 The wealthiest 1% of all Americans own over 50% of all the stocks and bonds.

#18 According to a new report from the AFL-CIO, the average CEO made 343 times more money than the average American did last year.

#19 In 1980, government transfer payments accounted for just 11.7% of all income. Today, government transfer payments account for 18.4% of all income.

#20 U.S. households are now receiving more income from the U.S. government than they are paying to the government in taxes.

#21 59 percent of all Americans now receive money from the federal government in one form or another.

#22 The average cost of tuition, room and board at America's public universities is now $16,000 a year. For America's private universities, that figure is $37,000 a year.

#23 The cost of college tuition in the United States has gone up by over 900 percent since 1978.

#24 Approximately two-thirds of all college students graduate with student loan debt.

#25 17 million college graduates are doing jobs that do not even require a college degree.

#26 According to the Bureau of Economic Analysis, health care costs accounted for just 9.5% of all personal consumption back in 1980. Today they account for approximately 16.3%.

#27 One study found that approximately 41 percent of working age Americans either have medical bill problems or are currently paying off medical debt.

#28 Back in 1965, only one out of every 50 Americans was on Medicaid. Today, one out of every 6 Americans is on Medicaid.

#29 Total credit card debt in the United States is now more than 8 times larger than it was just 30 years ago.

#30 During the first three months of this year, less new homes were sold in the U.S. than in any three month period ever recorded.

#31 Now home sales in the United States are now down 80% from the peak in July 2005.

#32 U.S. home prices have now declined 32% from the peak of the housing bubble.

#33 For most middle class families, the family home is the number one financial asset. Unfortunately, U.S. home values have declined an astounding 6.3 trillion dollars since the housing crisis first began.

#34 According to a recent census report, 13% of all homes in the United States are currently sitting empty.

#35 The housing crisis just seems to keep on getting worse. 31 percent of the homeowners that responded to a recent Rasmussen Reports survey indicated that they are "underwater" on their mortgages.

#36 Unfortunately, it looks like millions more middle class Americans could soon be in danger of losing their homes. According to the Mortgage Bankers Association, at least 8 million Americans are at least one month behind on their mortgage payments at this point.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.