With many of the giant US institutional funds holding commercial paper from European banks, your dollars in US money market accounts may not be much safer than euros at a Greek bank. For example, France-based BNP Paribas holds over $7 billion in Greek bonds, and it — along with other foreign banks similarly exposed to a potential Greek contagion — is widely-held by US money market funds.

Even for investors that prefer exposure to the euro, “the choice is still one of providing a loan to a bank through a deposit, or other avenues such as lending money to the Greek or German government, amongst many other choices.” Because you can hold the euro directly through German Treasuries, for example, euro-denominated assets can provide reasonable value opportunities even when reviled by the masses.

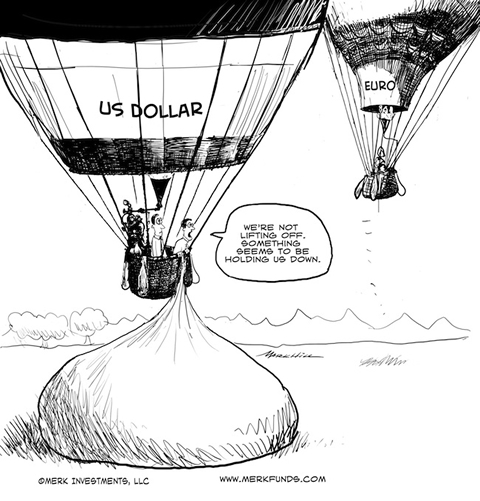

As should be expected, all the euro’s troubles are not necessarily good for the dollar… as usual, the devil’s in the details.

How Your Money Market Dollars are Tied to the Fate of the Euro originally appeared in the Daily Reckoning. The Daily Reckoning provides over half a million subscribers with literary economic perspective, global market analysis, and contrarian investment ideas. The Daily Reckoning regularly features articles by Addison Wiggin author of Empire of Debt, Chris Mayer Invest Like a Dealmaker, and Bill Bonner Financial Reckoning Day.

http://feedproxy.google.com/~r/dailyreckoning/~3/9UFWV9WEwmU/

No comments:

Post a Comment

Note: only a member of this blog may post a comment.