There’s no question in my mind that in the years ahead we’re going to see …

A sovereign debt crisis tear the euro apart and the European Union collapse.

The United States drown in its debts, the U.S. economy become officially mired down in a depression, and the U.S. dollar lose its world reserve currency status.

Inflation, despite seemingly deflationary forces, will soar through the roof, reaching unprecedented levels across the globe.

A crash in European and U.S. bond markets.

Gold soar through $5,000 an ounce, silver to at least $135.

Oil to at least $200 a barrel.

Food prices become a major cost and problem for every family on the planet.

And more, much more, including the complete collapse of today’s monetary system, capital controls, and eventually, an entirely new monetary system based on a single world currency that will be commodity-based for all international transactions.

But that doesn’t mean that in the short term, say the next few months, the markets can’t fall, and fall hard. It doesn’t mean there can’t be bouts of what will appear to be across the board deflation.

Advertisement

In fact, I expect one now. In the last several trading sessions we have seen …

The Dow Industrials break key support levels at 12,000 and 11,900.

Crude oil crack hard, plunging more than 4% last Thursday, and now threatening to break below $90 and head, first, to $80, then $70.

Silver starting to roll over again to the downside, and gold taking out short-term support at the $1,533 level.

In addition, we have seen …

The Nasdaq break key support at the 2,700 level, indicating that tech stocks, which were previously leading the rally in stocks, are now cracking.

Even the agricultural markets, grains like corn, wheat, soybeans and more, cracking hard, with wheat down more than 6% in the last week, and corn and soybeans showing a failed breakout pattern.

Plus, importantly …

Nearly all short-term cycles I monitor are now heading lower into at least late July, with the potential for an extended cycle low reaching into mid-September.

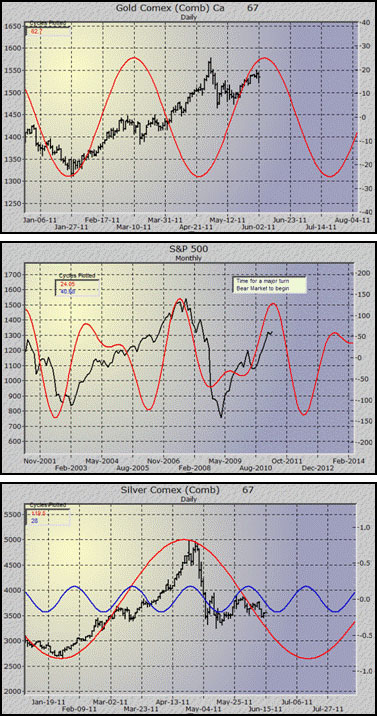

Just consider this monthly cycle chart of the S&P 500 Index, showing the important 24- and 40-month cycles. Notice how the market is peaking now in accordance with the cycles, and how they show a sharp slide heading into late October, early November.

Also consider this chart of the 62-day trading cycle in gold, which is clearly rolling over and pointing to a low heading into the mid to late July period.

Or, this chart of silver’s important 28- and 119-day (24-week) cycles, showing much the same as gold, pointing lower into early to mid-July.

The fact of the matter is that nearly all markets are now in a position of rolling over, creating potential massive downside moves that will catch most investors by surprise.

It won’t be pretty. But there are several things you can do now to protect your wealth and go for some potentially nice, short-term gains to boot.

First, the psychological ammo you need. Realize that any pullbacks you see, even if they are across the board slumps that turn out to be sharp, are only temporary. Even in the stock markets.

Healthy pullbacks that will serve to shift capital from weaker hands to stronger ones. Sad, but true. That’s how markets work.

So you don’t want to be one of the weaker hands. If you have core positions in gold and natural resources for the long term, stick with them. Don’t get shaken out. Instead…

Second, look for opportune price levels to add to your positions. I can’t give you all the details, or specific timing, in this column. Those are naturally reserved for members of my Real Wealth Report and my trading publications.

But I can give you the key support levels I will be watching in the most critical of markets. These are derived from the algorithms I developed for the markets nearly 25 years ago and, to this day, they are the most accurate methods I know of for identifying key levels no matter what the market. They are (along with some important notes from me) …

In the Dow Industrials:

— 11542.62 (a weekly sell signal if closed below on a Friday)

— 11518.44

— 11428.90

— 11350.27

— 10567.36In the S&P 500:

— 1279.00 (currently trading below it, a close below this level on June 30 will represent the first monthly sell signal in over two years)

— 1241.20

— 1173.60

— 993.50In the Nasdaq Composite:

— 2567.88

— 2459.79 (a weekly sell signal if closed below on a Friday)

— 2317.89

— 2397.57

— 2263.69

— 2023.03

— 1890.00In Gold:

— 1525.00 (a weekly sell signal if closed below on a Friday)

— 1477.80

— 1429.10

— 1383.50

— 1355.90

— 1332.80In Silver:

— 34.88 (a weekly sell signal if closed below on a Friday)

— 30.52

— 29.05

— 23.84In Crude Oil:

— 91.57 (a weekly sell signal if closed below on a Friday)

— 79.39

— 66.21Keep your eyes on the above numbers over the next several weeks and through the summer. I would even suggest printing this issue out and keeping a copy of it by your side. In each of the markets above, a closing below one level indicates a test of the next support area.

Third, consider the following measures for your funds …

A. If you’re invested in the broad stocks markets, in positions other than core gold miners or natural resource stocks, I suggest getting out. Period.

Don’t fret if there are bounces in the market. Just get out and preserve your capital. There will always be plenty of opportunities to get back in, with far less risk, and a lot more upside potential. Indeed, as this pullback unfolds, I expect the Fed to announce QEIII, which over the longer haul will serve to reinflate the broad stock markets much higher.

B. Keep the bulk of your powder dry, and in T-bill only money market funds. Yes, there’s zero return on investment there. But your money will be safe over the next few months.

C. For speculative funds, consider appropriate downside plays, such as inverse ETFs on the S&P 500, the Dow Industrials, and even the Russell 200 — with investments such as the ProShares Short S&P 500 Fund (SH) …

Or if you want to be more aggressive, the 300% leveraged inverse ETFs such as the ProShares UltraPro Short Dow 30 ETF (SDOW) … the ProShares UltraPro Short NASDAQ 100 ETF (SQQQ) … the ProShares UltraPro Short Russell 2000 ETF (SRTY) … and the ProShares UltraPro Short S&P 500 Index Fund (SPXU).

But in all cases, manage your risk tightly! There’s nothing wrong with taking a few small losses in a row when jockeying for the correct position and timing.

As I pointed out in my column last week, making money in the markets is all about managing your risk, being willing and able to accept strings of small losses … and being patient enough to let your winners run.

Stay safe, and best wishes, as always …

Larry

P.S. If you’re not already a member of my Real Wealth Report, I can’t think of a better time to join! The turning points arriving now in the markets will set the stage for a wild second half of this year, and a 2012 that promises to be critical for the world’s financial markets. The opportunities to protect and build your wealth will be some of the best ever. To join click here now.

http://feedproxy.google.com/~r/UncommonWisdomDaily/~3/Ka8Cnnzm16s/take-important-action-now-12234

No comments:

Post a Comment

Note: only a member of this blog may post a comment.